How Tax Benefits Largely Targeted For Children Fare Under The One Big Beautiful Bill Act (OBBBA)

The Decline Continues. Children Are Not A Priority

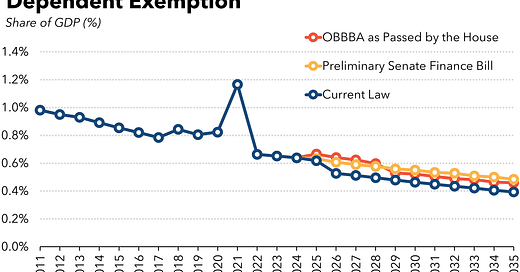

The Tax Policy Center has just posted the chart above, along with model estimates that can be found here. They show the continued decline, both relative to gross domestic product and in real terms, in the three major tax provisions mainly directed to families with children. Provisions in the House bill and Senate draft of the One Big Beautiful Bill Act do little to slow the rate of decline. An explanatory text from that post is as follows:

Three tax provisions—the child tax credit, the earned income tax credit (EITC), and the personal exemption for dependents—have significant effects on the tax burdens faced by households with children. Both the House and Senate versions of the reconciliation bill, also referred to as the One Big Beautiful Bill Act (OBBBA), increase the child tax credit and retain the elimination of the dependent exemption. The accompanying data illustrate trends in the tax value of these three provisions under current law and assuming the enactment of either the House or Senate bills.

When compared to past levels, including in 2017, future declines in the combined value of the child tax credit, EITC, and dependent exemption in real dollars and relative to the size of the economy as measured by gross domestic product (GDP) are primarily due to the way these provisions are indexed to change over time. Average household income rises with both inflation and real growth, whereas these three provisions have only sometimes been indexed for inflation and never for real growth.

These model estimates build upon historical data developed for the annual Kids Share estimates, which track how children fare in the budget. See also Maag, et al. How Policymakers Could Use the Tax Code to Serve Children Better